39+ Mortgage calculator prepayment lump sum

Your mortgage payoff date is 15072052. Get 247 customer support help when you place a homework help service order with us.

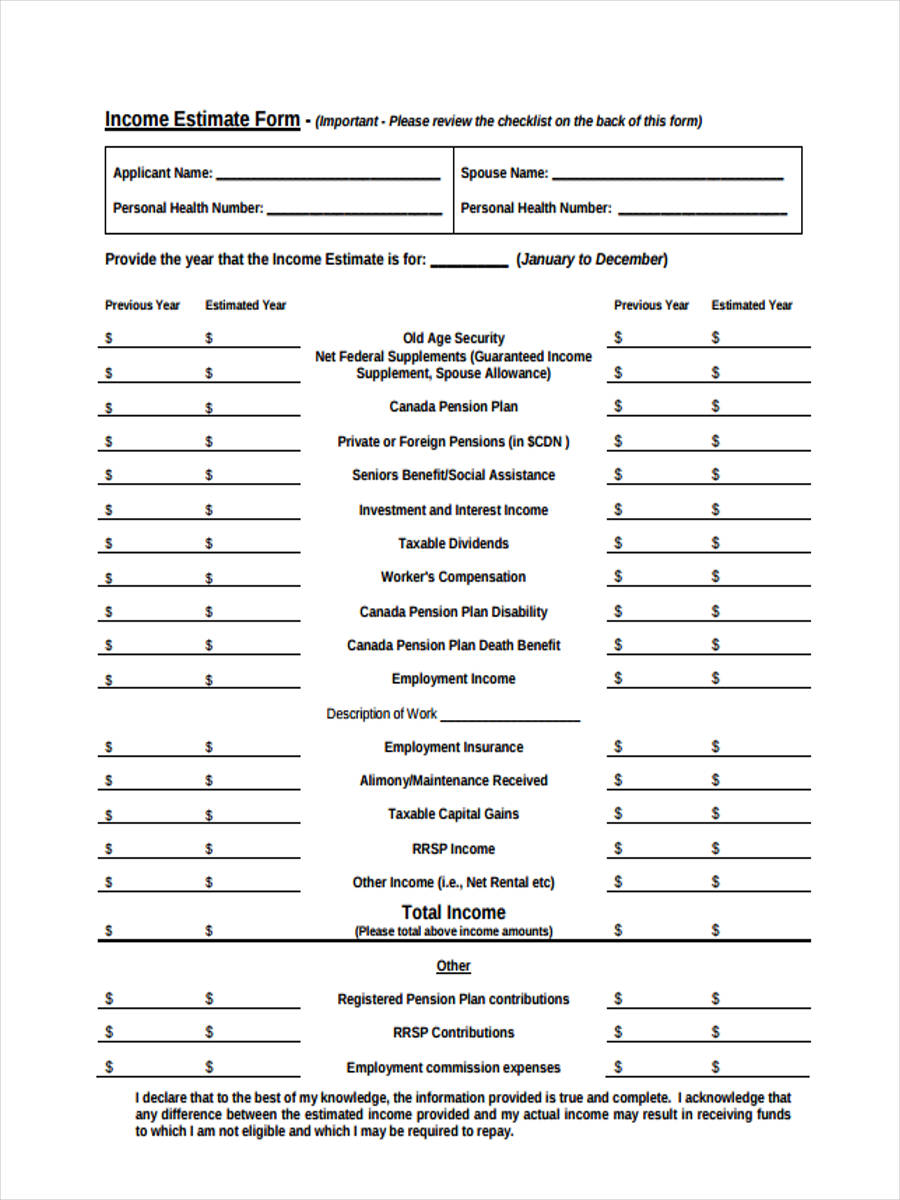

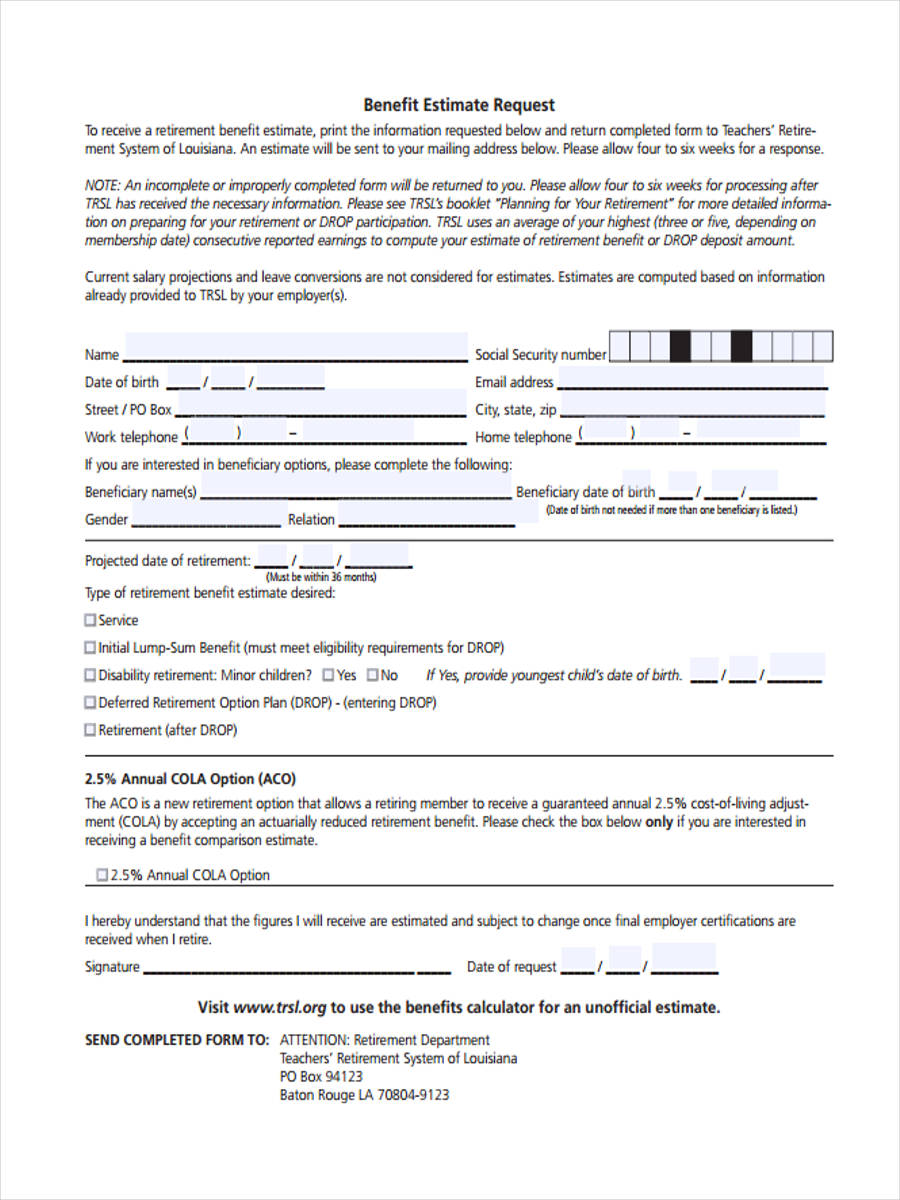

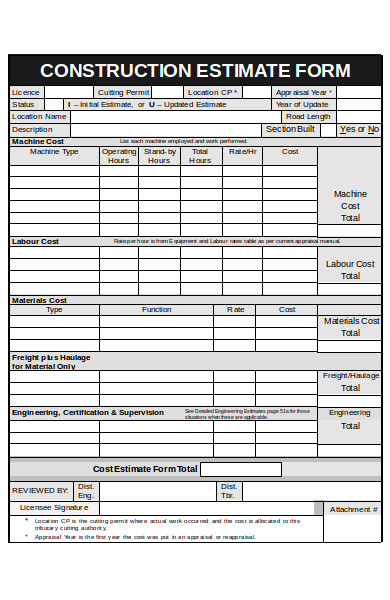

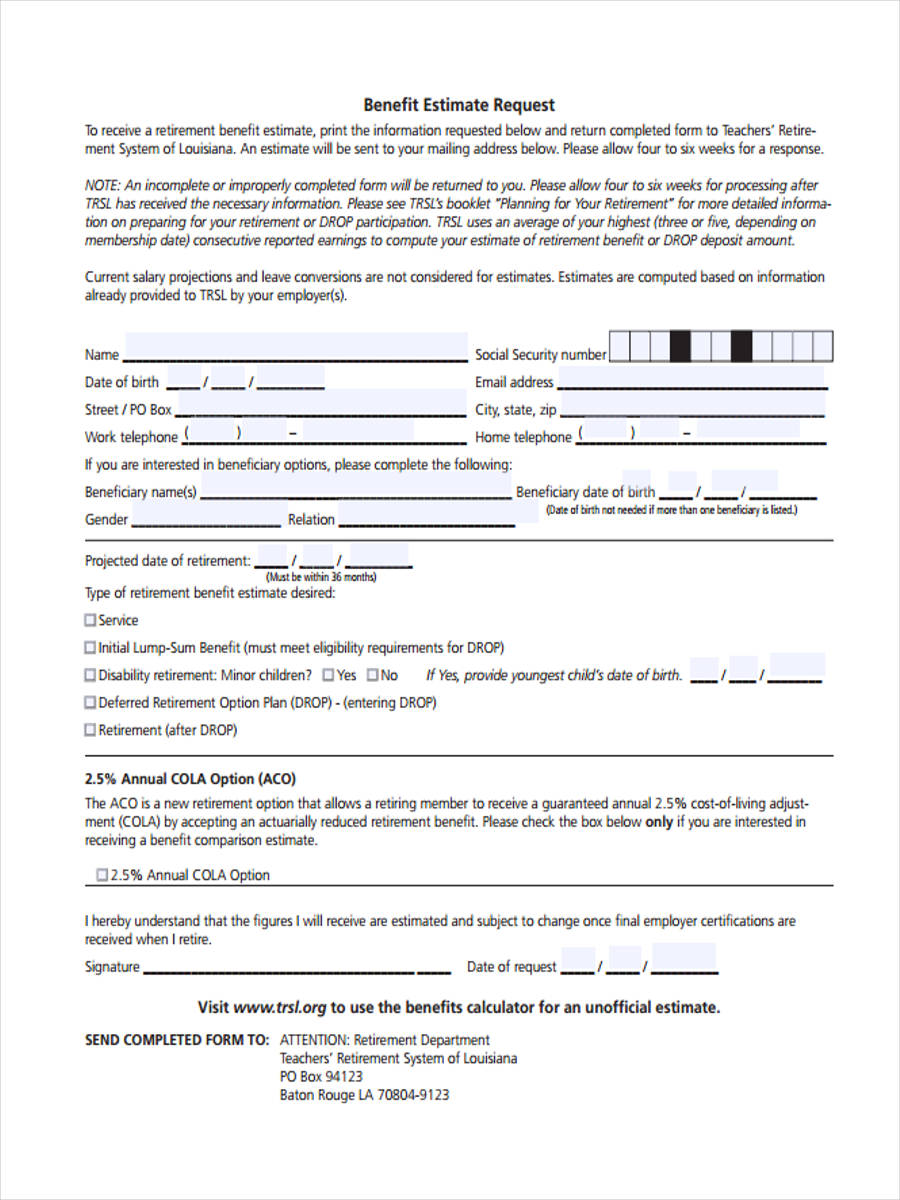

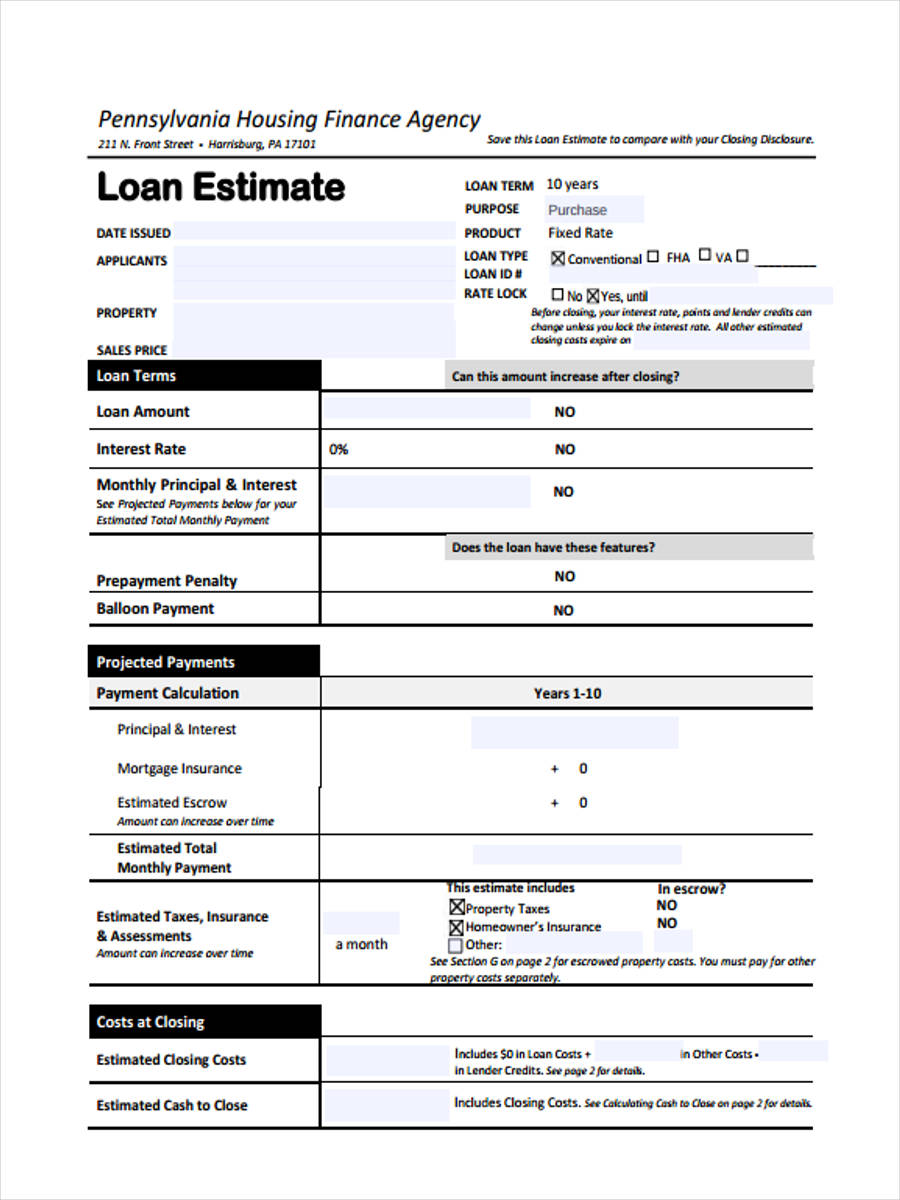

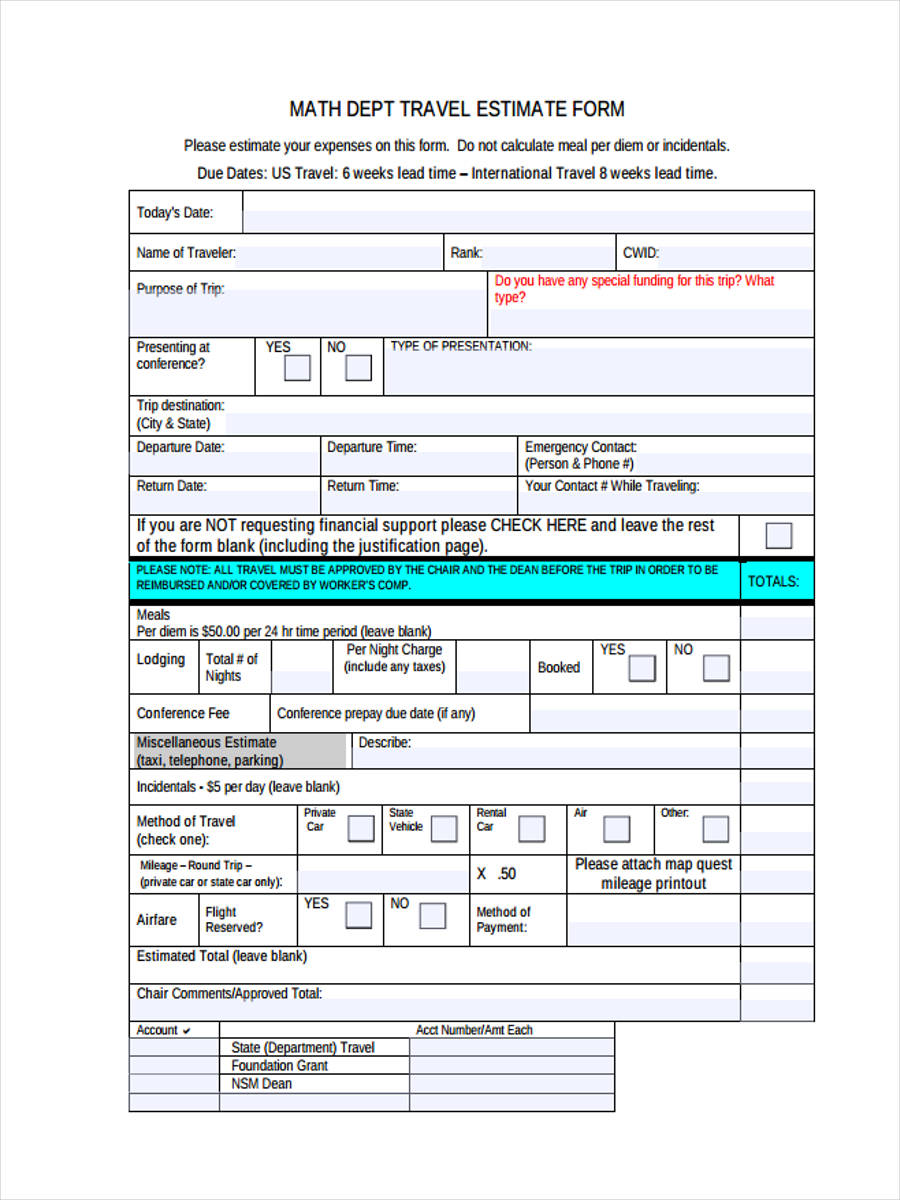

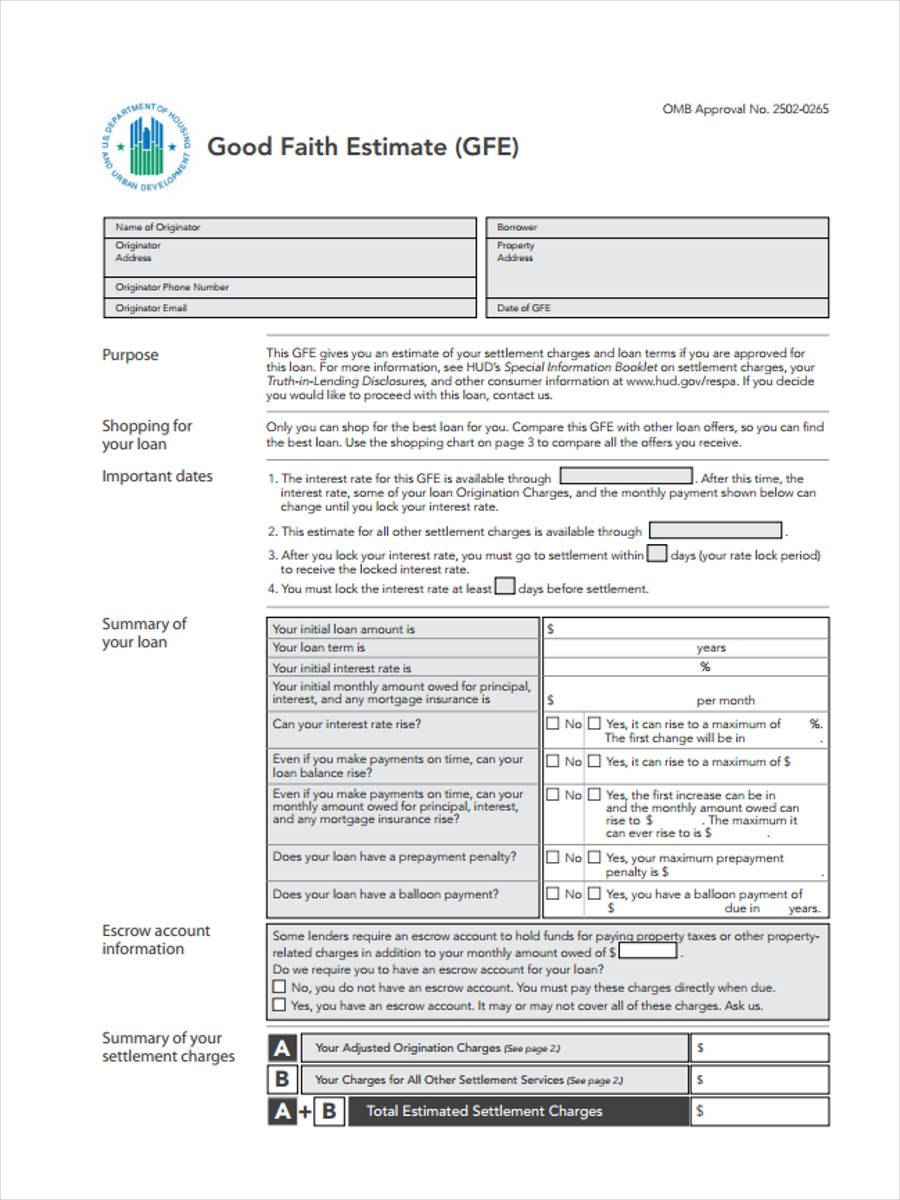

Free 39 Estimate Forms In Pdf Ms Word

The following chart shows how much you can save based on a one-time lump-sum payment of 60000.

. Lump sum prepayment Paid on. The payment is applied during the third year of the loan. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. After putting in just a few digits you will find out what your monthly payment and total payments will be. Mortgage Calculator Credit Card Calculator Money News Articles Loan Guides.

An amortization schedule consists of four parts the monthly payment interest payment principal payment and the remaining balance. Mortgage loan basics Basic concepts and legal regulation. A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property.

If you need to sell your home before the end of your mortgage term many lenders will allow you to port your mortgage. This student loan lump sum payment calculator shows how much you save and how much faster you pay off your student loans when you make a lump-sum payment. If you only have a couple more years to pay your mortgage ex.

Typically longer mortgage term. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments. ASCII characters only characters found on a standard US keyboard.

To estimate the cost of breaking your mortgage our mortgage penalty calculator is a useful tool. Or if youre expecting a lump sum of money through an inheritance or bonus that would allow you to pay more of your mortgage off. PMI Total periodic payment.

Insured high-ratio mortgages will have the lowest possible mortgage rate but youll need to pay for mortgage default insurance. Loan Prepayment Calculator to calculate how much you can save in total interest payments with mortgage prepayment and early payoff. More Choice We shop rates from over 350 lenders in Canada.

Mortgage Prepayment Calculator to calculate early payoff for your mortgage payments based on a desired monthly payment or the number of years until payoff. Loan Details Without Recasting After Recasting. According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan.

Mortgage Calculator Excel spreadsheet is an advanced mortgage calculator with PMI taxes and insurance monthly and bi-weekly payments and multiple extra payments options to calculate your mortgage payments. Must contain at least 4 different symbols. 739 299 - 993 299 - 993 Get My Rate.

Compare personal loans from online lenders like SoFi Marcus and LendingClub. The latter option lump sum pre-payment allows you to pay off up to say 25 of your mortgage loan again depending on your lender. Mortgage default insurance is financed through your mortgage.

Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older. Tend to get cheaper as you get older. 74028 Annual Balances.

Rates start as low as 5 for qualified borrowers. Bajaj Finance offers attractive fixed deposit interest rates up to 750 pa for citizens aged below 60 and 775 pa for senior citizens. Youre likely to get a better deal on your car insurance policy if you pay an annual lump sum rather than in monthly.

With Butler Mortgage you will find the lowest fixed variable mortgage rates deals in Ontario. How to Calculate Amortization Schedule. You can pay off a student loan early because student loans do not have any prepayment penalty.

Mortgage Calculator Credit Card Calculator Money News Articles Loan Guides. Mortgage Calculator Credit Card Calculator Money News Articles Loan Guides. A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination.

Make a lump sum payment - If you get a bonus at year-end receive an inheritance or your stock investment has grown and you decided to cash in. 30-39 1823 4494 40-49 2994. Second mortgages come in two main forms home equity loans and home equity lines of credit.

Second mortgage types Lump sum. Lump sum pre-payment. The percentage amount by which you are allowed to make this lump sum repayment is based upon your mortgages initial principal value.

Porting a mortgage means to take your current mortgage with its. So you can make a lump sum extra payment. 6 to 30 characters long.

5-year fixed mortgages are the most popular in Canada. How much income you need depends on your down payment loan terms taxes and insurance. This increase in payment will reduce your amortization period and thus the total interest paid on your mortgage.

Mortgage calculator is a simple tool that helps you estimate the cost of your mortgage. Invest in a Bajaj Finance Fixed Deposit for a fixed tenor as per your convenience and grow your savings at high FD interest rates. With a 20 down payment on a 30-year mortgage and a 4 interest rate you need a household income of 70000 yearly or more before tax.

If your mortgage has costly prepayment penalty. Lump sum payment recasting. Early Mortgage Payoff Calculator.

Pre-qualify for your personal loan today. 20 24-year-olds for example pay 1241 a year for fully comp cover 30 39-year-olds pay 627. Unlike closing costs such as legal fees and land transfer tax it does not require a lump sum cash outlay at the time you purchase your home.

30-Year Fixed Mortgage Principal Loan Amount. Variable mortgage rates have historically performed better than fixed mortgage rates although interest rates have generally fallen over the past few decades. A second option is to make a lump-sum payment directly towards the principal of your mortgage.

10 years over 30 years. When you take out a mortgage you agree to pay the principal and interest over the life of the loan. It doesnt have to be recurring and a one-time lump sum payment helps with your mortgage payment and reduces the.

We Offer Lower Mortgage Rates in Ontario From 433 5-Year Fixed Rate and 419 5-Year Variable. The mortgage calculator spreadsheet has a mortgage amortization schedule that is printable and exportable to excel and pdf. If you prefer you can arrange to provide a regular income for them instead.

Critical illness cover is a form of insurance that pays out a tax-free lump sum if youre diagnosed with a serious medical condition. Instead your mortgage default insurance premium is added to your mortgage amount and paid off over the life of your loan. Your family would usually get a lump sum that can help to pay off any debts like a mortgage as well as giving them money to live off.

Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially. You can then use this extra cash to make a lump sum payment towards your principal. Lets take a look at an example of how much more a borrower will pay at the end of a 30-year term compared to the 15-year term.

Free 39 Estimate Forms In Pdf Ms Word

Free 39 Estimate Forms In Pdf Ms Word

Free 39 Estimate Forms In Pdf Ms Word

Usda Loan Pros And Cons Usda Loan Understanding Mortgages Mortgage

Free 39 Estimate Forms In Pdf Ms Word

7 Steps To Paying Off Student Loans It S Possible Arrest Your Debt Paying Off Student Loans Student Loans Federal Student Loans

Free 39 Estimate Forms In Pdf Ms Word

Debt Service Ratios Gds And Tds Ratehub Ca

Free 39 Estimate Forms In Pdf Ms Word