25+ Mortgage borrowing salary

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. Add this amount to your deposit and youll find the budget for your new home.

25 Letter Of Explanation Templates For Mortgage And Derogatory Credit Word Best Collections

5 times salary mortgage.

. 2 Loan Processor Salaries provided anonymously by Prudential employees. No not always. Use How Much Can I Borrow calculator to know your borrowing capacity to pay for your mortgage personal or home loan based on your income expenditure.

- That Job Growth. For home prices 1. This is possible yes although as we have seen some applicants may be able to borrow more than others.

4-45 times your salary is the average income multiple used by most high street lenders so is often quoted as the amount you can expect to borrow. How Many Times My Salary Can I Borrow For A Mortgage. Most mortgage lenders use an income multiple of 4-45 times your salary some offer a 5 times salary mortgage and a few will use 6 times salary under the right.

Mortgage lenders in the UK. While the standard multiplier is often between 4 and 45x your salary various. How much times your salary can you borrow.

If you are unable to get a 6 times income mortgage you could still improve the amount of mortgage you are able to borrow by getting a joint mortgage with the maximum. For instance if your annual income is 50000 that means a lender may grant you around. Now however the benefit of applying with a partner or friend is the fact you will be provided with a loan based on both of your salaries rather than being offered a significantly.

A 500000 home with a 5 interest rate for 30 years and 25000 5 down will require an annual income of 124192. You need to make 138431 a year to afford a 450k mortgage. A lender we work closely with has recently announced a mortgage for 7x your salary for suitable candidates.

We base the income you need on a 450k. A typical mortgage length is 25 years. How much income do you need to qualify for a 450 000 mortgage.

Historically the mortgage market has been based on a salary-multiplier calculation restricting borrowers to 4 or 45 times their annual salary. If the home purchase price is between 500000 and 99999999 you must have at least 5 for the first 500000 and 10 for the remaining amount. Generally lend between 3 to 45 times an individuals annual income.

A combined salary of 100000 could be eligible to borrow 400000. What salary does a Loan Processor earn in your area. You can calculate how much.

Can you get a mortgage based on 6 times your salary. Read more about it here. This calculator is designed to illustrate how much you could borrow when approaching a mortgage lender to take out a mortgage based on your income.

Were not including any expenses in estimating the income you.

:max_bytes(150000):strip_icc()/preapproved_mortgage_FINAL-22c6cd19ccd34815a10baa195848112d.png)

5 Things You Need To Be Pre Approved For A Mortgage

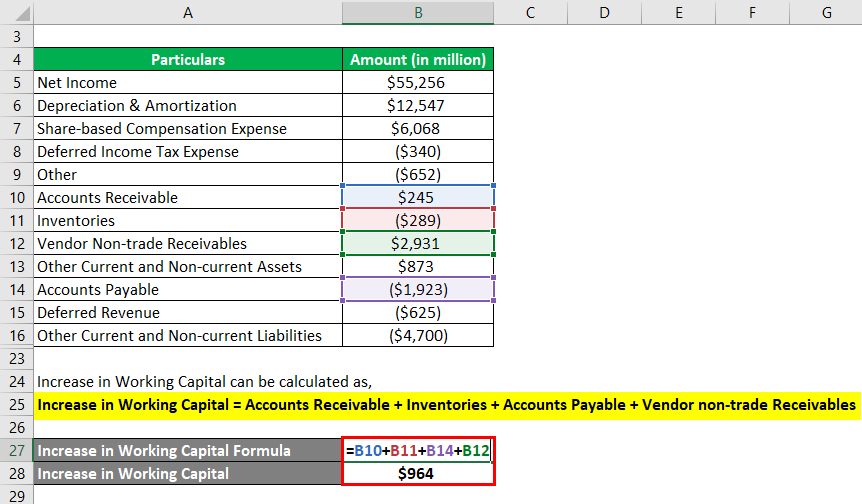

Operating Cash Flow Formula Examples With Excel Template Calculator

25 Letter Of Explanation Templates For Mortgage And Derogatory Credit Word Best Collections

Sample Pay Off Letter Geluidinbeeld With Payoff Letter Template 10 Professional Templates Ideas 10 Professional Payoff Letter Loan Payoff Mortgage Payoff

Bootstrap Client Or Partners Logo Showcase Example Clients Templates Template Design

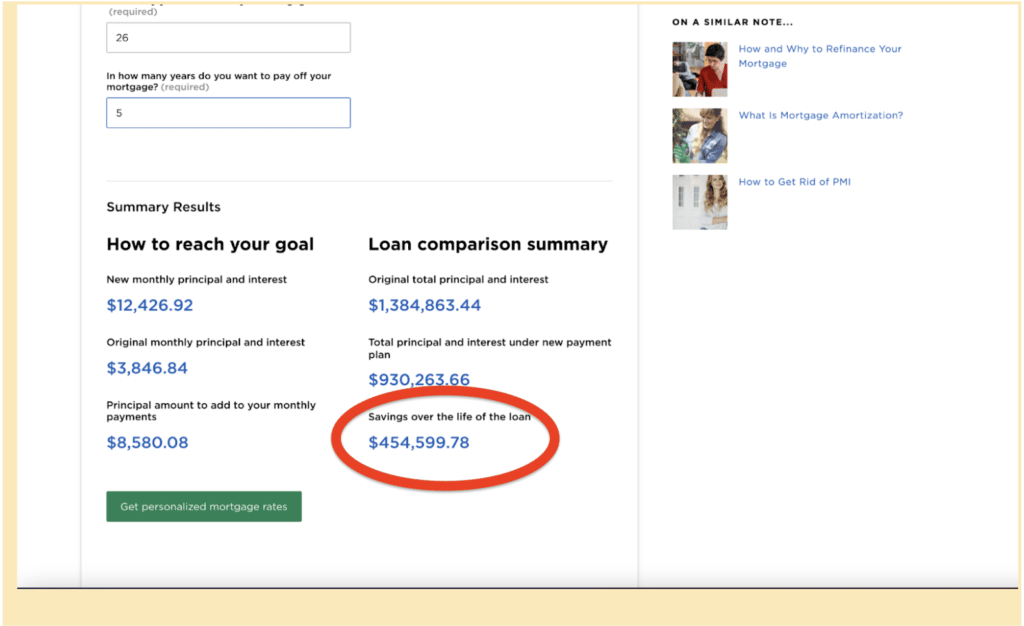

Ways To Pay Off Your Mortgage Early And Why We Did It

Bootstrap Client Or Partners Logo Showcase Example Clients Templates Template Design

Increasing Passive Income Through Leverage And Arbitrage

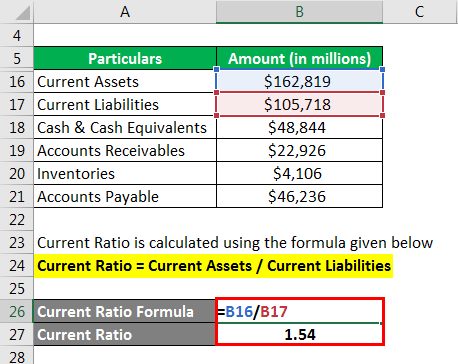

Ratio Analysis Formula Calculator Example With Excel Template

Ways To Pay Off Your Mortgage Early And Why We Did It

Maturity Value Formula Calculator Excel Template

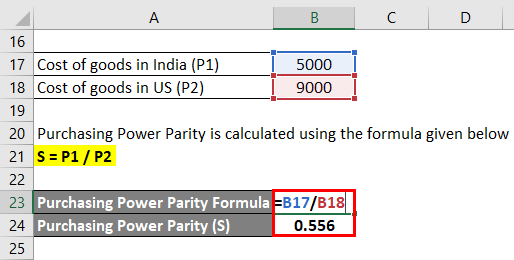

Purchasing Power Parity Formula Calculator Excel Template

25 Letter Of Explanation Templates For Mortgage And Derogatory Credit Word Best Collections

25 Letter Of Explanation Templates For Mortgage And Derogatory Credit Word Best Collections

Rick Rozman Owner Provider Of Low Cost Mortgages Exact Mortgage Inc Linkedin

25 Free Payment Schedule Templates Excel Word Pdf Best Collections

Ways To Pay Off Your Mortgage Early And Why We Did It